MD Property Owners – Tax Appeal Deadlines Approaching

Plan Now to Take Necessary Steps to Seek Reductions of Real Estate Taxes in the State of Maryland

By Jessica D. Lieberman, Esq.

Counsel at Selzer Gurvitch Rabin Wertheimer & Polott, P.C.

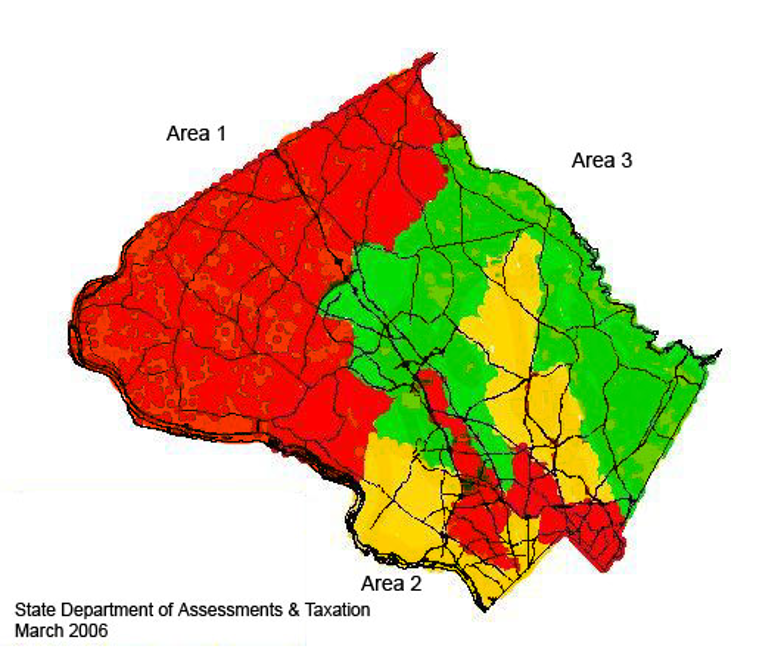

The 2023 reassessments of properties for real estate tax purposes will be taking place shortly in Maryland. Notices of Assessment will be sent to property owners at the end of December 2022 and the assessed values contained in those Notices will apply to the calculation of taxes for those properties for the 2023-2025 Tax Years. Appeals will be due approximately 45 days after the date the Notices are sent. One-third of properties in Maryland are reassessed each year. Some of the commercial areas in Montgomery County facing reassessment in 2023 are parts of Bethesda, Chevy Chase, Wheaton, Aspen Hill, Rockville, Olney, and Brookeville. These areas are shown in Area 2 (highlighted in yellow) of the below map. We are also able to file tax assessment appeals in many other Maryland counties. If you are uncertain as to whether your properties are being reassessed in 2023, we are able to assist you.

If your income-producing property is not being reassessed this year, but you have experienced a substantial loss of income during the current year, you may be able to obtain property tax relief for the remaining year(s) of the current triennial with the filing of a Petition for Review. The deadline to file a Petition for Review is January 2, 2023.

Let Selzer Gurvitch help you.

We can assist you with filing your assessment appeals and Petitions for Review. Please contact one of the following attorneys today!

|

Robert “Bob” C. Park, Esq. Of Counsel, Selzer Gurvitch rpark@sgrwlaw.com (301) 634-3147 |

|

Jessica D. Lieberman, Esq. Counsel, Selzer Gurvitch jlieberman@sgrwlaw.com (301) 634-3154 |